Every year around this time Gartner’s Contact Center as a Service (CCaaS) Magic Quadrant lands and every year the same ritual ensues: Leaders tout how important the research is, “happening” to mention that they’re one of them. Those not featured talk about how pointless the research is or why it’s so flawed (or plenty of media analysts do it on their behalf), whilst others measure pixel shifts with rulers confused about whether much has really changed. It becomes a highly contested or praised research note which means it matters, whether people like that fact or not.

This year has been no exception, it’s clear that 8×8 is not happy, (having an average seat-count expectation above 100 is unforgivable, it would seem). NICE is elated, of course, bragging about literally moving into the top spot. Zoom feels vindicated, although many feel they’ve been robbed of a better position. Talkdesk was always ahead in innovation and it clearly went all out on execution this last year to get the result it needed. We could spend hours endlessly appraising these vendors and deciding if the Gartner analysts are any good at their job or not when in actual fact none of it would matter as much as the more important message this graphic is now telling us: the category itself is running out of road and buyers need to consider why.

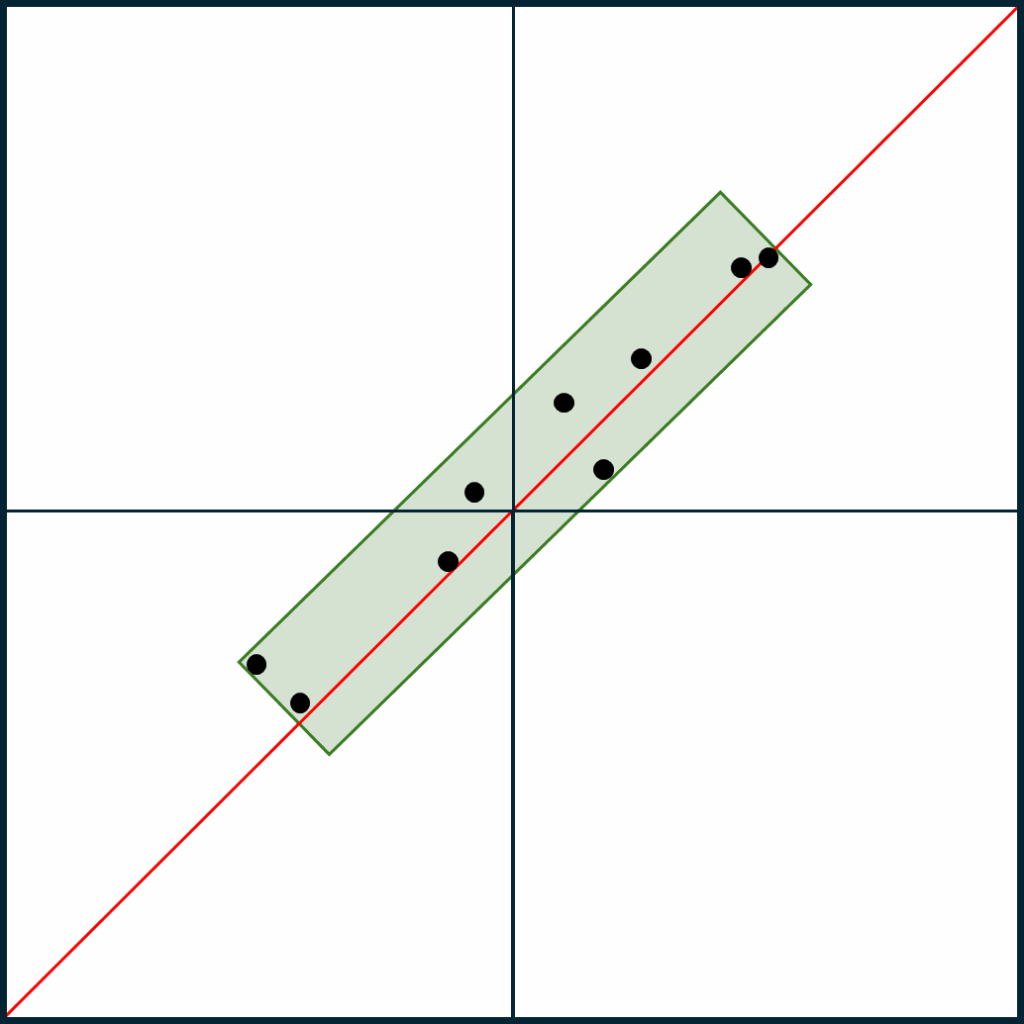

Next to No Challengers and No Visionaries

There are two crucially important factors to consider, here:

- Less than 10 percent of the methodology-driven framework is actually being used.

- Almost every vendor sits neatly on the diagonal.

So, what does this mean? Are the margins too tight? Are the barriers too high? Or is there simply no future in pure CCaaS? These vendors may be hitting an innovation ceiling based on such a narrow categorization.

Think of the Apple iPhone. Each year buyers ask the same question: has it really changed enough to upgrade, or should I stick with what I have? What makes them buy isn’t the phone itself, but paradigm shifts, ecosystem expansion, and now AI-powered benefits, sometimes even just a better camera. If it’s measured only as a phone, how can Apple truly differentiate?

These vendors face the same ceiling, and analysts can only stretch the research so far. In this MQ, buyers really have two choices: pay big dollars for a big-name leader, or spend less on a niche player that delivers nearly the same. But any shift on one axis is quickly matched by the rest, leaving the market stuck in its place. The only way forward is to expand the breadth and depth of this MQ.

What’s Missing From Challengers?

Mega-vendors like SAP, Oracle, Microsoft, Salesforce, with huge execution power but still not the kind of vendors the purist Contact Center manager would naturally turn to. They’d have some proving ground coming from an apps or platform space to dare suggest they understand contact center well enough. Perhaps, they’d still be working on “getting it” to improve the relevance of their innovation in the contact center, specifically? Either way, they’re completely absent. And that’s a problem.

It is a multi billion dollar industry they overlap with heavily. They could truly challenge, but that will not happen in a “CCaaS” MQ.

What Should Visionaries Look Like?

Flipping to the bottom right of the 2×2 and finding it’s empty is just as big a problem. This suggests a stagnating market with no interest from smaller “startups” who have the much needed passion and innovation required to inspire, be disruptive and grab the market by the scruff of the neck and move it to a new and better place. We need visionaries to inspire the world and force the leaders to be kept on their toes.

The barrier of entry is decided by the clients, typically, but is it right? Perhaps there is just nothing more that can realistically be done, again, in this “CCaaS” MQ.

The real takeaway is this: without Challengers and Visionaries, the research no longer delivers the complete picture buyers need from a single MQ. And no amount of incremental CCaaS improvement will change that.

The Customer Service Magic Quadrant

It has become increasingly confusing for buyers to determine which customer service and engagement solution to buy. Made even more complicated by the onslaught of AI narratives vendors are pushing, blurring the lines between CRM CEC (Customer Engagement Center) and CCaaS solutions: it’s almost impossible to know if you’re making the right choice.

These vendors are competing head to head for the same contact center seats, while in coopetition with one another. Zendesk buying Local Measure and Salesforce + ServiceNow investing $1.5B in Genesys signal a convergence that will only accelerate. Meanwhile, the land grab through Workforce Engagement Management (WEM) M&A has led vendors in both camps to standardize on AI enabled QM because WFM is the hard part. They need to deliver on the true design of WEM to make a difference, and vendors like RingCentral who just acquired CommunityWFM have every opportunity to do that.

Buyers need better guidance across these landscapes to identify the right customer service solution, without having to piece it together from multiple MQs or rely on the merits of one that was retired in 2021, (April 2021 we said goodbye to the WEM MQ).

The prediction: within two years, Gartner will retire the CCaaS MQ and launch a new Customer Service MQ that blends CEC, CCaaS and WEM into one.

Not just because this is something the industry has been talking about for a while or just expects. Because it’s then we’ll see the completeness of options for buyers across all four quadrants.

Any and all vendors MUST be thinking about that future if they want to get ahead. Buyers, you’ll have to piece it together until then.

Nirvana isn’t “better CCaaS.” It’s total customer service orchestration.

Read Count: 2412